Opinion

RISK CAPITAL

How philanthropy can accelerate innovation in mental health

In the wake of Oct. 7 and the ongoing war, Israel is facing a mental health crisis of historic proportions. The ripple effects of trauma are everywhere, from the frontline to the home front and across all sectors of society. The need for effective trauma care is urgent, but meeting today’s needs is not enough — we must also build the mental health systems of tomorrow.

This is where philanthropy has a unique and powerful role to play.

dickcraft/Getty Images

Philanthropy’s unique superpower

In times of crisis, many philanthropists understandably prioritize scaling what works — evidence-based treatments like cognitive behavioral therapy or group counseling provided by experienced clinicians. These interventions are essential and should be funded widely, particularly when speed and reach are critical.

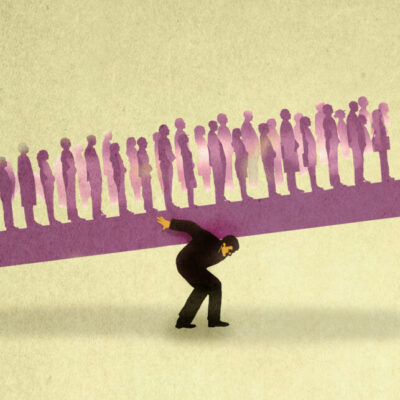

But if philanthropy limits itself to the “tried and true” alone, we risk freezing progress. Innovation often begins at the margins, with new technologies, untested methods or unfamiliar partnerships that fall outside the scope of government funding or commercial investment. This is where philanthropic capital is most valuable: as flexible, risk-tolerant funding that can nurture early-stage ideas and carry them through to scalable, system-changing solutions.

We’ve seen this model work in global health. The Gates Foundation, for instance, invested early in mRNA vaccines when few others would. Those investments helped pave the way for Moderna and BioNTech, saving millions of lives. Could philanthropists do for trauma what Gates did for vaccines?

The answer is yes — and the time is now.

Betting on the future of trauma care

Israel’s innovation ecosystem, coupled with its deep pool of mental health expertise, makes it an ideal testing ground for wellbeing and mental health solutions. Virtual reality, digital therapeutics and AI-driven diagnostics are already being piloted here. However, most of these efforts need early capital to prove their effectiveness and adapt their solutions to the Israeli context, whether that means translating platforms into Hebrew or testing protocols with frontline populations. These are not always attractive bets for traditional investors, but they are precisely the kinds of opportunities philanthropy can and should take on.

According to data from the Startup Nation Finder platform, 2024 saw a dramatic uptick in investment in mental health technology in Israel, with private funding jumping 66% to $123 million after a slowdown in 2023. This surge reflects renewed investor confidence and highlights the sector’s resilience. Notably, 85% of mental health startups in Israel are still in early development stages — a striking contrast to 65% across the broader health sector — pointing not only to high growth potential but also a clear need for early-stage funding to expand solutions and validate impact. This mapping provides a snapshot of this vibrant and rapidly evolving space.

Creative capital for complex needs

Supporting trauma innovation doesn’t have to mean only giving outright gifts. There’s a growing global movement toward “venture philanthropy,” where donors use creative funding models that combine impact with sustainability. These include:

- Forgivable loans that help early-stage ventures get off the ground, with repayment only if they succeed.

- Social impact bonds, where public funders repay investors only if the intervention meets pre-agreed outcomes.

- Evergreen funds, where any returns are reinvested in the next generation of solutions.

- Profit-pledge models, like Israel’s own Tmura, where startups commit a portion of future earnings to social causes.

These tools allow philanthropists to act as catalytic investors, de-risking innovation and building a pipeline of mental health solutions that can scale — all while ensuring returns are used to support further impact, not private gain.

Imagine a U.S.-based donor using their donor-advised aund (DAF) to fund a post-traumatic stress disorder treatment pilot in Israel via a social impact bond.

An Israeli foundation providing a zero-interest loan to a digital therapeutics startup to adapt its platform for IDF veterans.

A global impact investor using an evergreen fund to support trauma centers in both Tel Aviv and Kyiv.

According to Dalia Black, co-founder of ReHome and founder and CEO of Weave Impact, these methods have already successfully been adopted in Israel, just not at scale: “Financial loans have supported mental health NGOs to help them scale their services in instances where there is a clear revenue generation stream or expected revenue from the government. ReHome also provides loans to families displaced by the Oct. 7 attacks who cannot return home due to place-based trauma, helping them relocate permanently.”

Each approach is different, but all share a common thread: treating philanthropic capital not as charity but as a strategic lever for long-term change. Before jumping in, funders should ask key questions to ensure their support goes where it matters most:

- Impact: Is there a theory of change, measurable outcomes, and a clear target population?

- Sustainability: Can the program scale in a sustainable way?

- Collaboration: Is the program aligned with national priorities and coordinated with other actors in the field?

- Governance: Is the team credible, transparent, and equipped to deliver?

- Risk: Are the reputational or ethical risks understood and managed?

These aren’t just due diligence checkboxes. They are what will turn today’s donation into tomorrow’s legacy.

A dual mandate: Now and next

Israel’s trauma burden is growing, and the effects of trauma don’t wait for budget cycles or clinical trials. That means philanthropy must walk a fine line, supporting immediate care at scale while simultaneously building the innovation pipeline that will transform mental health for the long haul.

This “both/and” mindset is essential. For example, a philanthropist might fund therapy sessions for Nova survivors today, while also backing the adaptation of a VR treatment platform for Hebrew-speaking users. The latter may not seem like a top priority in a crisis, but it’s precisely these kinds of investments that make the next leap possible.

Trauma doesn’t end when the war does — and neither should our ambition.

A legacy of healing

Addressing trauma is not only a moral imperative; it’s an economic, social and security issue. It’s not just the right thing to do, but the smart thing to do. Untreated PTSD affects productivity, health, family life and national resilience. Our collective mental and behavioral health has a huge macro impact on all layers of society. With the right mix of compassion, innovation and strategic investment, Israel can not only heal its wounds but become a global leader in trauma recovery.

This is the opportunity of a generation. Philanthropy can be the bridge from crisis to recovery, from pilot to policy and from pain to possibility.

Let’s make sure we cross it.